Say goodbye to manual DeFi Operations

AI got you covered

Our AI Agents leverage a vast array of on-chain data points to accurately forecast yields, volatility, and liquidity trends. This eliminates the need for manual liquidity allocation, as the AI Agents autonomously manage all aspects of the process in a proactive and predictive manner.

Our AI Agents leverage a vast array of on-chain data points to accurately forecast yields, volatility, and liquidity trends. This eliminates the need for manual liquidity allocation, as the AI Agents autonomously manage all aspects of the process in a proactive and predictive manner.

AI Agents you can trust

NOYA's ZKML implementation enables on-chain proving of private & predictive AI models which enables trustless & verifiable strategy execution.

The lowest fees possible through DEX & Bridge aggregators

NOYA elevates the DeFi experience by minimizing slippage and fees through the seamless integration of bridge and DEX aggregators.

Liquidity flows to where it's needed the most

Self learning and predictive AI Agents allocate liquidity across multiple chains, assets, and protocols, ensuring sustainable growth in an ever-evolving DeFi landscape.

Protocols built on top of NOYA

Trustless Uniswap Liquidity Provisioning

Multi-Tier, Multi-Chain, Multi-Asset pools

Native Omnichain Borrowing Optimizer

Optimizing borrowing rates

Leveraged Yield Farming Aggregator

LTV management using ZKML

Native Omnichain Yield Aggregator

Aggregating yield and diversifying risk across multiple chains

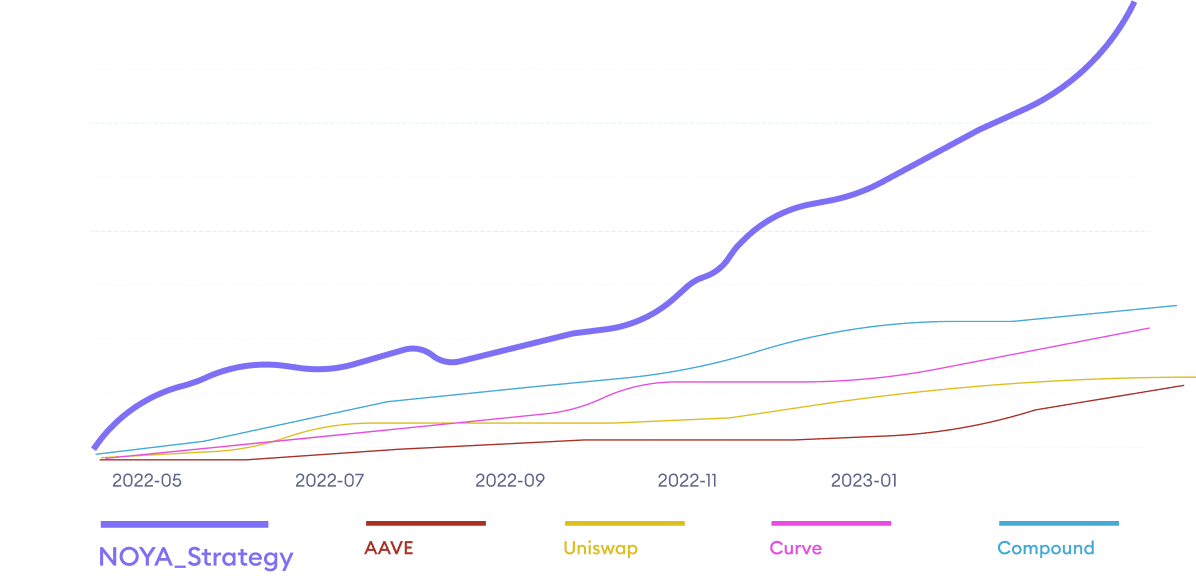

Unleash exceptional returns with NOYA's game-changing

game-changing agent-first approach

ETH Strategy

Stables Strategy

10+ chains

40+ protocols

500+ pools

FAQ

Frequently Asked Questions